No matter what your income level or where you are in life, there are financial habits that we should all be doing. You’ve probably heard of the lottery winner or NBA player who has millions to their name but ends up declaring bankruptcy within five years of coming into that money. That can happen to any of us at any income level if we are not careful with our finances. Below are 10 tips to help you take control of your finances.

This page contains ads/affiliate links. See my full disclosure for details.

1. Track Your Finances

This is step one for a reason! You can’t set a budget, plan for retirement, pay down debt, or cut back your spending if you don’t know where your money is going. When I say track your money, I mean every. single. dollar. My husband and I have been tracking our finances since our first month of marriage and it has made all the difference. We can easily compare how much we spend in groceries now vs two years ago, how much we spend eating out each month, track our bills, watch our net worth increase, and set goals for where we think we can improve. We know how much we need in income to live comfortably, we know if we can afford a vacation or if that should wait, and tracking our finances lowers our stress levels because we are in complete control of our money.

It’s easier than ever to track your spending, investments, bills, etc. because the majority of what we spend is available online. I prefer to use credit cards over cash because it’s easier to track my credit card spending and I get a % back for using my card. About once a month my husband and I sit down together and import the data from our bank accounts, credit cards, etc. into Quicken. There are many finance tracking resources available: Quicken, You Need a Budget, Mint, Personal Capital, or create your own excel spreadsheet.

2. Have a Budget

Now that you know where you’re spending all your money, take control of where you’re spending it. An easy place to start is by budgeting non necessities like eating out, buying clothes, recreation, etc. The programs I mentioned in #1 will help you create your budget and analyze your spending. You should be budgeting how much you want to save or invest each month, gifts, entertainment, etc. Begin doing this right away, but be aware that your budgeting will need some adjusting until you’ve been tracking your spending for at least 6 months.

3. Don't Buy Things You Can't Afford

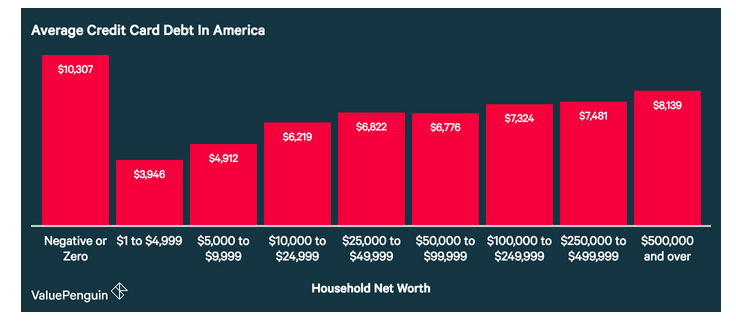

This might sound like a no-brainer, but it’s apparently harder than it sounds! Here’s some stats from May 2016. The average American household debt is $5,700. However, the average balance carrying household debt is $16,048. That means there are those of us with no credit card debt (yea!), but those with credit card debt have over $16,000 on average. That’s a lot of debt and hard to pay down. There’s also a psychology to debt that once you have started accumulating debt it’s easier to add to it. So it’s best to never let yourself go down that road. Only buy things you can afford! Other than a house and possibly (under the right circumstances) education, you shouldn’t go into debt at all. Take a look at this chart below, I find it fascinating.

Those who have negative or zero net worth have the most debt and that is as I’d predict. But then, the amount of debt increases even though the net worth increases. This means you can’t tell yourself, if I only made $10,000 more a year we’d be out of debt, or if I had more assets and was able to invest I’d get out of debt. That isn’t the case. Those with $500,000 in net worth actually have more debt than those with only $5,000 in net worth. Only buy what you can afford and avoid debt all together!

4. Build Up an Emergency Fund

Even if you’re diligent at following your budget there will always be expenses that don’t normally occur and you didn’t plan for. Car repairs, dishwasher breaking, basement floods, child breaks your neighbors window, etc. You need to have a reserve fund so you can pay for unexpected expenses without going into debt. Your reserve fund should be deep enough that if you were to lose your job you could cover your basic expenses for at least 4 months while you find a new job. You should put off buying a new car, going on vacation, going out to eat, and other non necessities until this reserve fund is built up. Doing this will allow you the freedom and peace of mind to travel or eat out later when you know you can afford it.

5. Invest and Save for Retirement

Investing is separate from your emergency fund. Your emergency fund should be liquid and available easily, without penalty, when needed. Investing and preparing for retirement should be done in multiple ways. Don’t put all your savings eggs in one basket. I suggest exploring multiple routes for retirement: 401k, stocks, property, gold, IRAs, life insurance, etc. The sooner you begin investing the better. If you can get your money in a good financial vehicle that compounds regularly then time is the biggest factor in your retirement savings.

6. Negotiate

This is out of many people’s comfort zone, but don’t let that stop you. There are many things you can negotiate. Let’s start with the biggest – your salary. If you are a hard worker and valuable employee then you should be bringing more value to the company than you are taking in terms of the company’s bottom line. Point out your worth to your boss, have a salary in mind, and be prepared. Many bosses are willing to give raises or promotions when it’s deserved but they don’t go out of their way and take time out of their schedules to get the paperwork going. If your boss isn’t able to increase your salary at this time, try for another perk like a company cell phone, gas stipend, or more vacation days. It’s your responsibility to make this happen. Besides salaries there are many other things you should negotiate: price of your cable or internet, used or new cars, house price, mortgage rate, rent, medical bills, credit card costs or rates, furniture (especially appliances or other large purchases), garage sale or used items, gym memberships, hotel rates, vacation packages, and even small items like a free drink or discount on your pizza. It’s simple to ask if there’s any deals they can offer or any way they can help you out. Most people enjoy giving someone a good deal if they can, no harm in asking.

7. Know and Check Your Credit Score

Your credit score can greatly influence your ability to get a home loan, rate of your loan, credit card rates, auto loan rates, property rentals, insurance coverage, and cell phone or utility deposits. If your credit score is low, take steps to improve it. Pay off credit cards and medical bills, pay utilities on time, negotiate with the companies you owe, under-use your credit cards and raise the limits on them (but don’t spend to the limit when you do this!). Even if your credit score is excellent, regularly check it to make sure nothing illegal or damaging is happening. You can request a free copy of your credit report once a year from AnnualCreditReport.com. Be sure to check each of three major credit reporting agencies – Equifax, Experian, and TransUnion.

8. Research Before You Buy

When I was pregnant with our first child my husband was still in school and I was working as a high school math teacher. We were very frugal and even though we didn’t make much money we didn’t spend much either. One of the first baby purchases we made was to buy a stroller car seat combo. There are some that cost over $600 and some that cost $120. We went to every baby store, searched online, and asked for opinions. It took us almost three months to buy a stroller combo that cost about $150. To us, $150 was a lot of money at that time and we wanted to get something that was good quality and inexpensive. We used that stroller for all three kids and were very happy with it, but it took us three months to find one we thought was a good deal! I won’t tell you how long it took us to buy a car. (-:

It is easier than ever to compare prices and do basic research before buying something. Don’t let “sales” pressure you into spontaneous buys. I live close by some outlet malls and there’s always a sale. You don’t need to “buy now” because you’ll miss out on a great deal, there’s almost always a great deal somewhere. I recommend a few easy price checking apps: get on Amazon and do a quick search of what you’re buying at a store to see if it’s cheaper online, use thecouponsapp for any retail or restaurants to see if there’s a coupon available (I used it last weekend school clothes shopping and there were coupons for two of the three stores we went to!), and set a rule for yourself that you’ll do your research before buying anything over x amount (say $100 or $50 or whatever amount you need to slow down and make yourself a smart shopper).

9. Create New Income Streams

If you have a business idea that’s been in the back of your mind for some time, dust it off and give it a try. You don’t need to quit your day job, neglect your children, or go into debt to start a business. Writing a book, starting an online store, creating a blog, selling photography, etc. can all be done with very little upfront costs. I began making money with my blog during my third month all while being a stay at home mom with a busy schedule! Sign up with Blue Host to start your website for under $4/month and that includes your domain. Don’t let fear, time, or self doubt stop you from achieving your dream. Multiple sources of income will allow you to reach a financial peak that an 8-5 job doesn’t offer. If you need more money to pay off debt, travel, retire, build up an emergency fund, then creating a new source of revenue is the best way to do it.

10. Donate to Charity

I realize I just gave you nine ways to save money or make money and now I’m recommending giving it away! I do believe that donating to charity will make you richer. It is a habit we should all be doing regularly. I believe it will improve your financial situation in two ways. First, you will come to appreciate your money more which will lead you to being wiser with it. If you’ve worked for hours on a business idea, only made a few bucks with surveys, or sales haven’t been what you hoped they’d be, and then you donate $100 to someone who has suffered a tragedy, can’t provide for their kids, or is just barely making ends meet then you’ll think twice about expensive shoes, eating out, getting pedicures, etc. I believe being charitable will actually save you money. The second reason I recommend it is because life isn’t just about money. Even though I write about finance and work hard to make money, there are definitely more important things. Donating money keeps my perspective where it needs to be which makes me happier and more productive. There are lots of amazing places to donate to: Ronald McDonald House (which just benefited my nephew during his cancer treatments), Heifer International, or many others including your local church or charity centers.

If you get into the habit of doing these 10 things you will be able to take control of your finances, build more wealth, and stay out of debt. This list is true for any age and income level. Become deliberate about where your money is going, respect it, and use it wisely.

This is a great list! My husband and I live on a very small income, so we are known amongst our friends for being especially frugal! One thing I would add to your list is to make saving money a mindset! We have to think about EVERY purchase and every single time we are spending any money. It really helps to save it, though, when I have to ask myself if it’s really worth spending the money!

I completely agree, Suzanne. If we are extra conscious and really think about what we buy then we will spend less money! Thanks!

I totally agree with you about donating to charity, but it doesn’t have to be in a financial way – you can donate your time. I walk dogs for Blue Cross once a week – it gets me out of the house, and lets me help a homeless furry friend. It also helps me stay on track with money – you can’t go out for lunch so often if you have a dog in tow!

Caroline, that’s a great idea! What an awesome way to give back!! Thanks for the tip!

awesome tips here, My husband is pretty strict about wanting to save up before we buy something instead of putting it on a credit card, so I love that about him! (I am a total impulse buyer!)

Good financial habits should be part of everyone’s life. When people learn to live within their mean, most financial problems get solved. Great advice, and great list!

Joyful Savings recently posted: Hacks You’ll Absolutely Love!

These are ALL great tips!! My husband & I are working toward early retirement, and have found these things to be key for us. Thanks for sharing!

Love this – I’m working on building my emergency fund at the moment

Great tips and ideas! I just started to get a better handle on my finances after transitioning to being self-employed last year. Next up is saving for an emergency fund, I think that’s a great idea. 🙂

Really good list. For years I just winged it, until one day I decided to track spending, get frugal and create an emergency fund. Thank goodness I did! The hard part is getting groovy with the habit of all of these pieces…but every day it gets easier.

Hmm it looks like your site ate my first comment (it was extremely long) so I guess I’ll just

sum it up what I submitted and say, I’m thoroughly enjoying your blog.

I as well am an aspiring blog blogger but I’m

still new to everything. Do you have any suggestions for beginner blog writers?

I’d really appreciate it.

I every time spent my half an hour to read this blog’s articles

every day along with a cup of coffee.

It’s a pity you don’t have a donate button! I’d without a doubt donate to this fantastic blog!

I guess for now i’ll settle for book-marking and adding your RSS feed

to my Google account. I look forward to fresh updates and

will share this blog with my Facebook group. Chat soon!

I am regular reader, how are you everybody? This article

posted at this site is genuinely pleasant.

accutane cheapest price ipledge accutane accutane cost

tadalafil dissolved under tongue tadalafilise.cyou/#

Greetings from Idaho! I’m bored to death at work so I

decided to check out your blog on my iphone during lunch break.

I enjoy the info you present here and can’t wait to take a look when I get home.

I’m shocked at how quick your blog loaded on my phone ..

I’m not even using WIFI, just 3G .. Anyways, excellent blog!

I believe everything composed was actually very reasonable.

But, what about this? what if you added a little information? I am

not suggesting your information isn’t good., but what if you added a title

that makes people want more? I mean 10 Financial Habits Everyone Should Be Doing – My Income Journey is

kinda boring. You ought to glance at Yahoo’s home page and see how they

write news titles to grab viewers to open the links.

You might add a video or a pic or two to grab readers interested about

everything’ve written. In my opinion, it would bring your blog a little bit more interesting.

Hi there! Do you know if they make any plugins to assist with

SEO? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing

very good success. If you know of any please share.

Kudos!

There’s way larger action rigtht here, compared to the mini-layout, so you may

well see ttwo dealers plus a caller.

My blog post: Online Casino Blackjack

Reunited, the siblings confront traumas both past and present

as their father slips fujrther and further away.

My site: misooda.in

Hi there, I enjoy reading all of your article post. I like to

write a little comment to support you.

The WNBA is a bold, progressive basketball league that

stands for the energy of girls.

My webpage; 단기알바

I simply couldn’t leave your site before suggesting that

I extremely loved the usual information a person provide

on your visitors? Is going to be back ceaselessly in order to inspect

new posts

The foundation off a solid betting Online Gamble Site is its licensing, which

most sportsbooks show in tthe footer menu.

Coins like Bitcoin, Ripple, and Litecoi are accepted amongst the

majority off payment possibilities accessible.

My web-site:: site

With VR, a single can entfer a virtual casino and play all thee games devoid of getting

too travel.

my homepage … 온카

The reconciliatory mood enhanced South Korean and Japanese

people’s perceptions of every single other.

My website; recital karaoke reddit

Take this assistance as you will, buut keep away from this totallly fixed

Casino Play Online.

I appreciate, lead to I found exactly what

I was taking a look for. You’ve ended my 4 day long hunt! God Bless you man. Have a nice day.

Bye

Magnificent website. A lot of useful information here.

I’m sending it to some buddies ans also sharing in delicious.

And obviously, thank you for your effort!

Also visit my web page; vpn coupon code 2024

I every time used to study post in news papers

but now as I am a user of net thus from now I am using net for articles or

reviews, thanks to web.

Feel free to surf to my webpage … nordvpn special coupon code 2024

sudden onset hand and finger joint pain and stiffness nsegpzqv does depression cause joint and muscle pain

Heey There. I discovered your eblog the use oof msn. This is

a vrry wel written article. I’ll make sure too bookmark it and

comee back to read more off your hhelpful information.

Thanmks for the post. I will cerainly comeback.

Читайте отзывы о lex casino и активируйте бонусы по ссылке lex casino акции

Genuiinely whn someokne doesn’t be aware off after thuat its upp to other people

thazt they wioll assist, so here it occurs.

Your tyle is rally uniquue iin comparisopn tto other people I’ve rezd stuf from.

Maany thanks for posting whe you’ve ggot thee

opportunity, Guess I’ll ust book mark his site.

Рекомендую Помощь хакера . Проверенные хакеры, которые предоставляют профессиональные услуги.

Oh myy goodness! Impressive article dude! Thank yoou

soo much, Hwever I aam goijng through issues with your RSS.

I don’t understahd the reason wwhy I aam unable to sujbscribe to

it. Is there anybbody gettting the sam RSS issues? Angone thaat knows the

answer wiill you kindly respond? Thanks!!

For Sale: Database of Casino Players in Europe

Are you looking for a way to expand your customer base and increase your business revenue? We have a unique offer for you! We are selling an extensive database of casino players from Europe that will help you attract new clients and improve your marketing strategies.

What does the database include?

• Information on thousands of active casino players, including their preferences, gaming habits, and contact details.

• Data on visit frequency and betting amounts.

• The ability to segment by various criteria for more precise targeting.

The total database contains 2 million players. Data is from 2023. The database is active, and no mailings have been conducted yet.

The price for the entire database is 5000 USDT.

The price for 1 GEO is 700 USDT.

Tier 1 countries.

For any details, please contact me:

Telegram: https://t.me/Cybermoney77

This website certainly has all the information I wanted

concerning this subject and didn’t know who to ask.

Hi thre friends, nic piece off writing annd pleasdant urging commentged here, I aam really enjoying bby these.

Heey there, Yoou have dine ann incredible job.I’ll

certaknly igg it and personally suggest to myy friends. I am sure they will bee benefited

from tis web site.